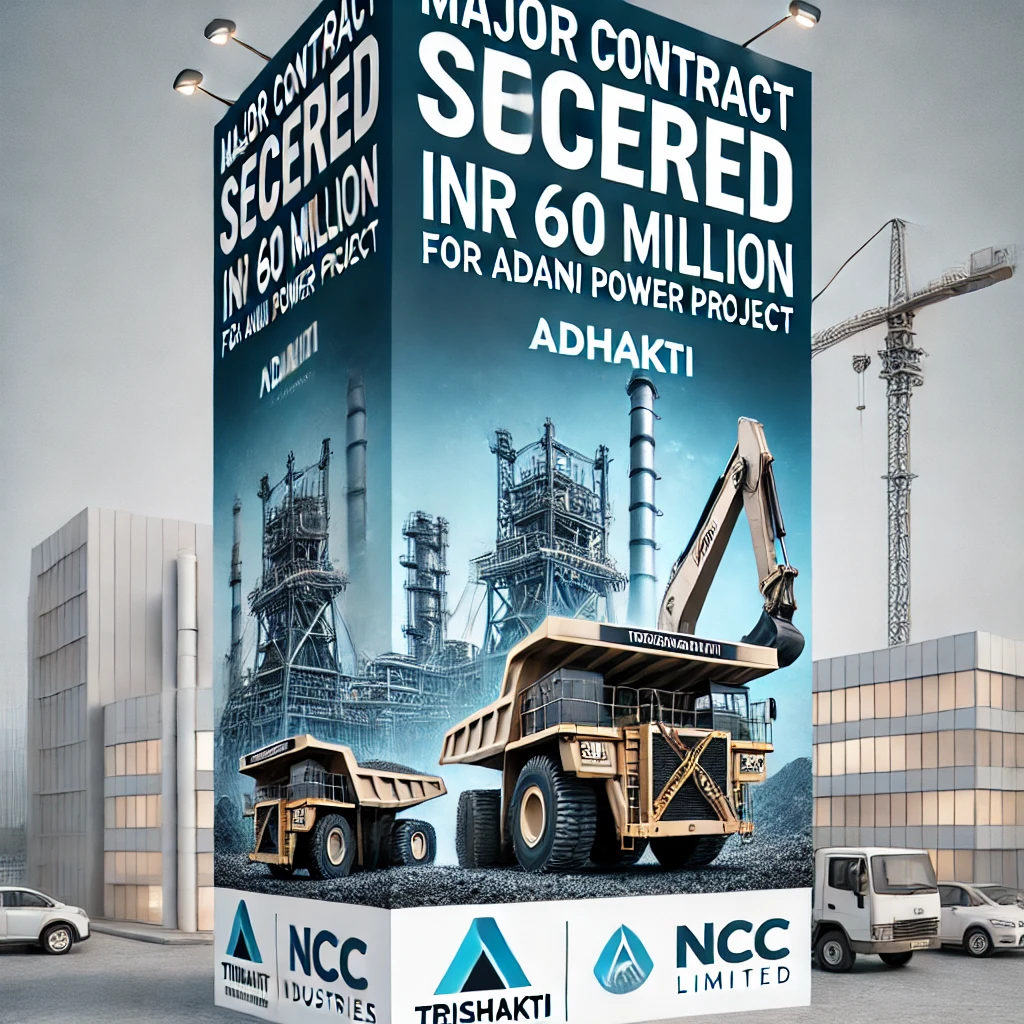

rishakti Industries Limited has proudly announced the acquisition of a major contract from NCC Limited. The agreement involves the deployment of advanced earth-moving heavy equipment to support NCC’s ongoing Adani Power Project.

This significant contract reaffirms Trishakti Industries’ position as a reliable partner in the infrastructure sector, offering high-capacity equipment solutions for large-scale projects.

Key Details of the Contract

- Name of the Awarding Entity:

- NCC Limited

- Scope of Work:

- Supply of advanced earth-moving heavy equipment for the Adani Power Project.

- Contract Size:

- INR 60 Million.

- Nature of the Award:

- Domestic contract for equipment supply.

- Execution Timeline:

- Effective immediately, with a project duration of 12 months.

- Promoter/Group Interest:

- The promoters or group companies of Trishakti Industries Limited do not have any interest in NCC Limited. The transaction is not a related party transaction and is conducted on an arm’s-length basis.

Strategic Impact

The contract is expected to have a positive impact on the company’s financial performance in the upcoming quarters, reflecting its growing expertise and market leadership in supplying heavy equipment for large-scale infrastructure projects.

Official Announcement

The company’s detailed disclosure has been filed under Regulation 30 of the SEBI (Listing Obligations and Disclosure Requirements) Regulations, 2015, and SEBI circular no. SEBI/HO/CFD/PoD2/CIR/P/0155. For more information, you can access the official document using the link below:

Disclaimer

This article is for informational purposes only and does not constitute an offer to buy or sell securities of Trishakti Industries Limited or any other entity. Investors are advised to conduct independent research and consult a qualified financial advisor before making any investment decisions.

Important Disclaimer

This content is written by Chiman Soni, a CS Executive student and founder of Corporate Laws Hub. The information provided is for educational purposes only and should not be construed as legal or financial advice.

Readers should consult qualified professionals for specific legal or financial queries.

Content Sources

Information compiled from: MCA, ICSI, SEBI, Income Tax Department, GST Portal, IP India, Supreme Court of India, BSE, NSE, and other authoritative sources.

Support Independent Content

Help us continue providing high-quality educational resources by making a donation. Every contribution makes a difference!