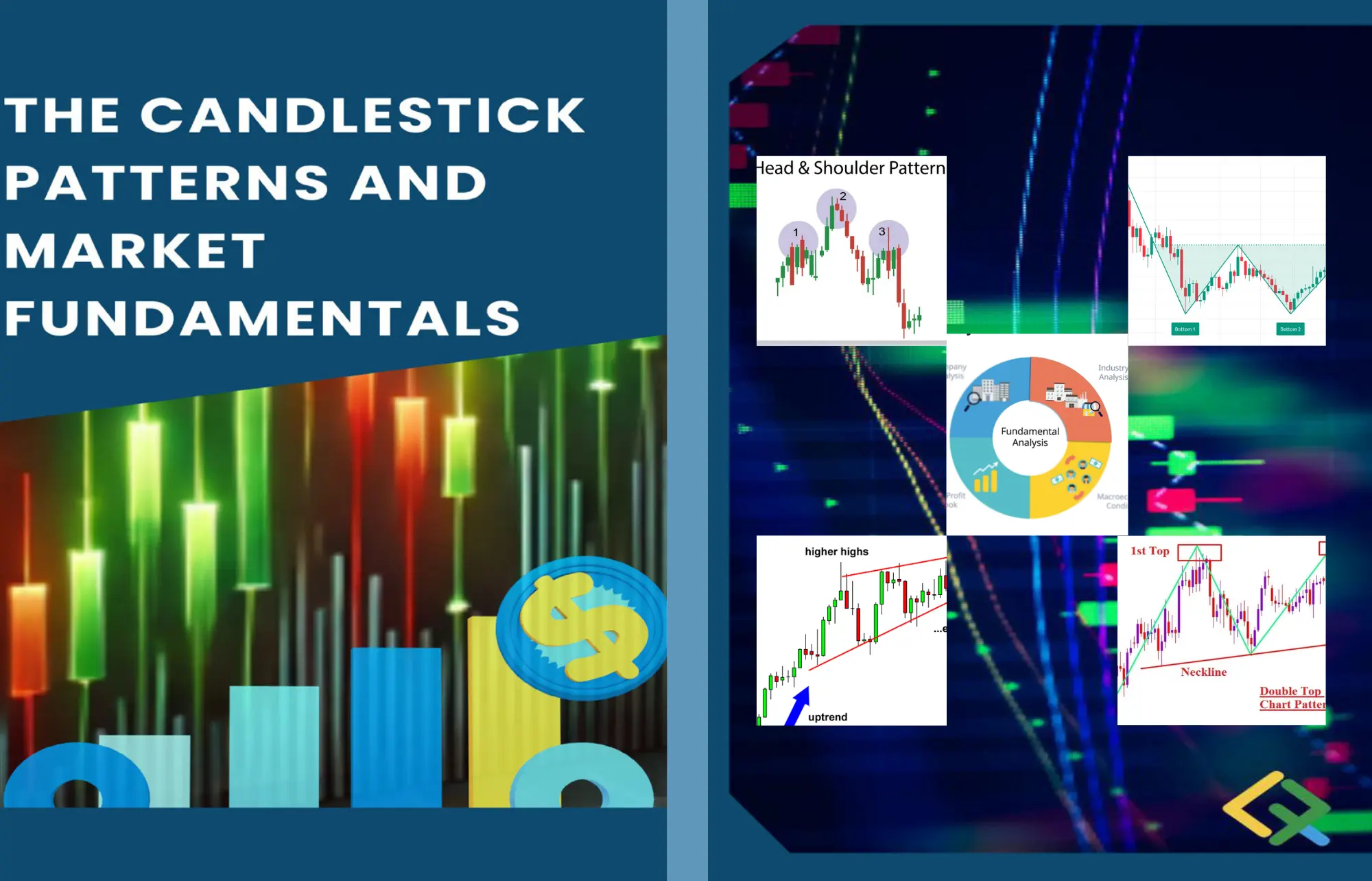

Mastering the Dual Approach to Trading Success: Candlestick Patterns and Market Fundamentals

In the fast-paced world of trading and investment, success hinges on your ability to make well-informed decisions. The Candlestick Patterns and Market Fundamentals is your ultimate guide to mastering the dual approach of technical and fundamental analysis. This comprehensive book seamlessly combines candlestick charting techniques with deep insights into financial analysis to help you navigate the complexities of the financial markets. Whether you’re a beginner or an experienced trader, this book equips you with the tools to succeed.

Part A: Unlock the Secrets of Candlestick Charting

Candlestick patterns are a timeless tool utilized by traders around the globe. They provide a visual representation of market sentiment and help identify potential price movements. This book dives deep into the world of candlestick charting to give you the edge you need in the market.

1. Single Candlestick Patterns

- Doji: Learn how this pattern signals indecision and potential reversals.

- Hammer and Hanging Man: Understand the implications of these patterns in bullish and bearish markets.

- Shooting Star: Identify this pattern to anticipate price declines.

2. Multiple Candlestick Patterns

- Engulfing Patterns: Recognize bullish and bearish engulfing for precise entry points.

- Morning Star and Evening Star: Discover how these patterns forecast trend reversals.

- Three White Soldiers and Three Black Crows: Utilize these patterns to confirm market trends.

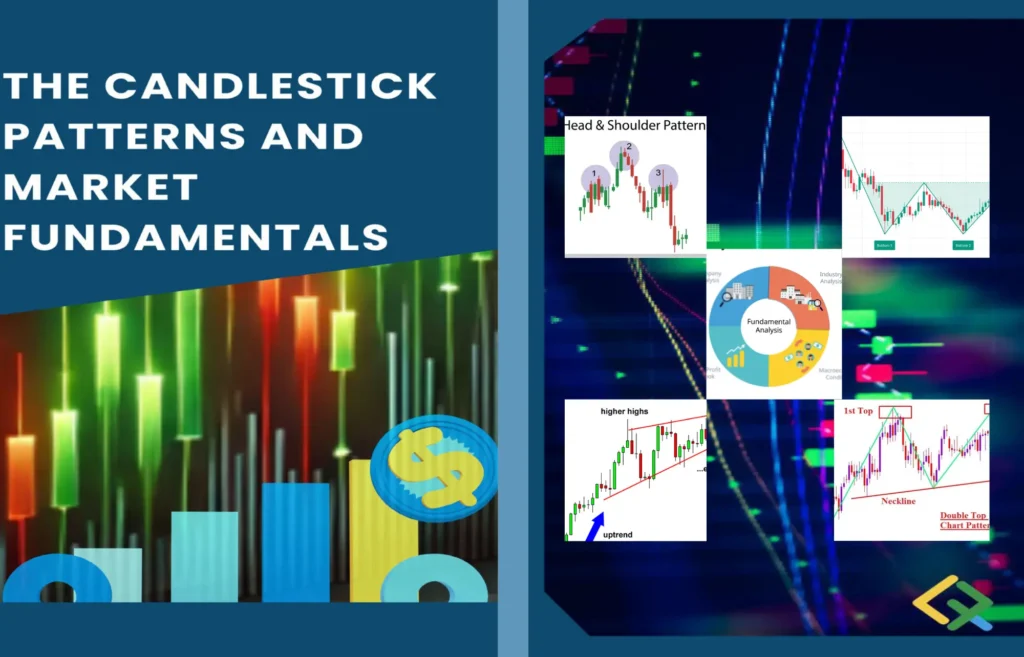

3. Advanced Patterns

- Head and Shoulders: Detect this popular pattern to predict trend reversals.

- Flags and Pennants: Use these continuation patterns to spot breakout opportunities.

- Triangle Formations: Analyze symmetrical, ascending, and descending triangles for market insights.

4. Real-Life Examples

This book doesn’t just explain patterns—it shows you how to use them in real-world trading scenarios. Gain practical experience with examples from stocks, forex, and cryptocurrency markets.

Part B: Discover the Power of Fundamental Analysis

Fundamental analysis dives deep into the financial health and intrinsic value of assets, giving you a solid foundation to make long-term investment decisions. Here’s what you’ll learn:

1. Understanding Financial Statements

- Balance Sheets: Assess a company’s assets and liabilities.

- Income Statements: Evaluate profitability and revenue streams.

- Cash Flow Statements: Determine liquidity and cash management efficiency.

2. Key Financial Metrics

- Price-to-Earnings (P/E) Ratio: Gauge stock valuation and market sentiment.

- Price-to-Book (P/B) Ratio: Understand the relationship between market value and book value.

- Dividend Yield: Analyze returns from dividend-paying stocks.

3. Discounted Cash Flow (DCF) Models

Master the art of calculating intrinsic value with actionable examples that simplify complex concepts.

4. Industry and Economic Analysis

Evaluate macroeconomic trends and industry-specific factors to make informed decisions in any market condition.

Practical Strategies for All Market Conditions

Whether you’re a trader or an investor, this book is packed with actionable strategies:

1. Combining Technical and Fundamental Analysis

Learn how to blend candlestick patterns with fundamental data to develop a holistic trading approach.

2. Strategies for Every Trading Style

- Day Trading: Quick strategies for short-term profits.

- Swing Trading: Capitalize on intermediate market moves.

- Long-Term Investing: Identify undervalued assets for sustainable growth.

3. Risk Management and Trading Psychology

Understand how to manage risk effectively and maintain the right mindset for success in volatile markets.

Who Should Read This Book?

Beginners

Build a strong foundation in technical and fundamental analysis.

Experienced Traders

Refine your strategies and gain new market insights.

Investors

Identify undervalued assets and maximize long-term returns with confidence.

Why Choose This Book?

With clear explanations, real-life examples, and actionable advice, The Candlestick Patterns and Market Fundamentals bridges the gap between technical and fundamental approaches, making it an indispensable resource for traders and investors of all levels. Whether you’re looking to sharpen your trading skills or make better investment decisions, this book is your roadmap to success.

Ready to Master Trading?

Don’t miss out on the opportunity to elevate your trading and investment game. Get your copy of The Candlestick Patterns and Market Fundamentals today!

Important Disclaimer

This content is written by Chiman Soni, a CS Executive student and founder of Corporate Laws Hub. The information provided is for educational purposes only and should not be construed as legal or financial advice.

Readers should consult qualified professionals for specific legal or financial queries.

Content Sources

Information compiled from: MCA, ICSI, SEBI, Income Tax Department, GST Portal, IP India, Supreme Court of India, BSE, NSE, and other authoritative sources.

Support Independent Content

Help us continue providing high-quality educational resources by making a donation. Every contribution makes a difference!