The Professional’s Guide to

Candlestick Patterns &

Market Fundamentals

Master institutional-grade trading strategies combining technical patterns with fundamental drivers for superior market performance.

TRUSTED BY PROFESSIONALS

Institutional-Grade Trading Knowledge

Discover the same strategies used by hedge funds and professional traders, now distilled into this comprehensive guide.

Technical Analysis Mastery

From basic candlestick patterns to advanced chart formations used by professionals, gain the visual literacy to spot high-probability setups.

- 50+ candlestick patterns with real-world examples

- Volume analysis and confirmation techniques

- Multi-timeframe analysis framework

Fundamental Analysis Framework

Learn how professional analysts value assets and identify market-moving fundamentals before they’re priced in.

- Financial statement deep dive (10K/10Q analysis)

- Valuation models (DCF, comparables, sum-of-parts)

- Macroeconomic indicators and their market impact

Professional Trading Strategies

Combine technical setups with fundamental catalysts for high-probability trades with favorable risk/reward ratios.

- Institutional order flow analysis

- Risk management protocols

- Portfolio construction techniques

Professional Chart Pattern Recognition

Learn to identify high-probability setups with our institutional-grade pattern library.

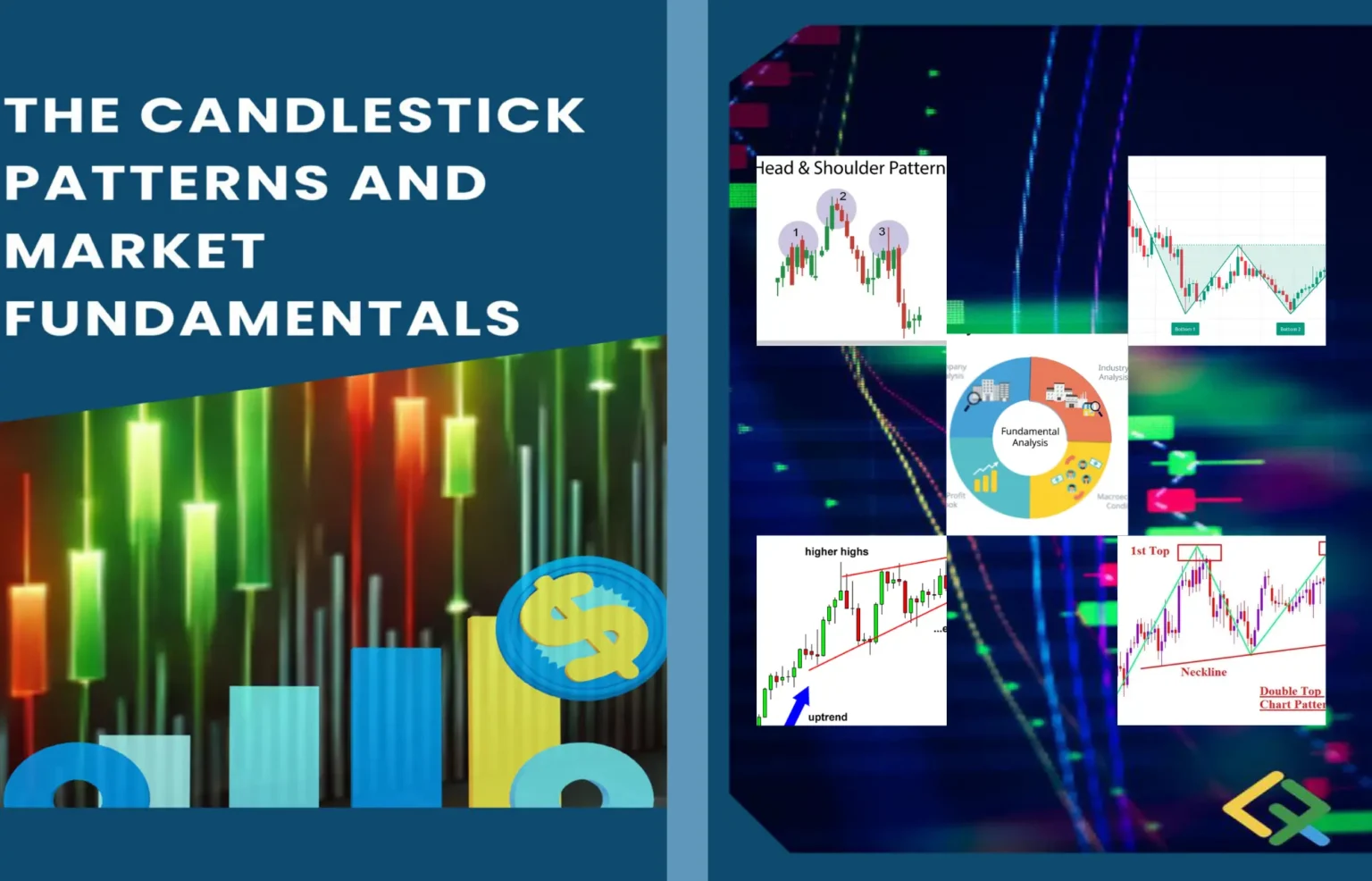

Morning Star Pattern

A bullish reversal pattern appearing after a downtrend, signaling potential exhaustion of selling pressure.

Evening Star Pattern

A bearish reversal pattern appearing after an uptrend, indicating potential exhaustion of buying pressure.

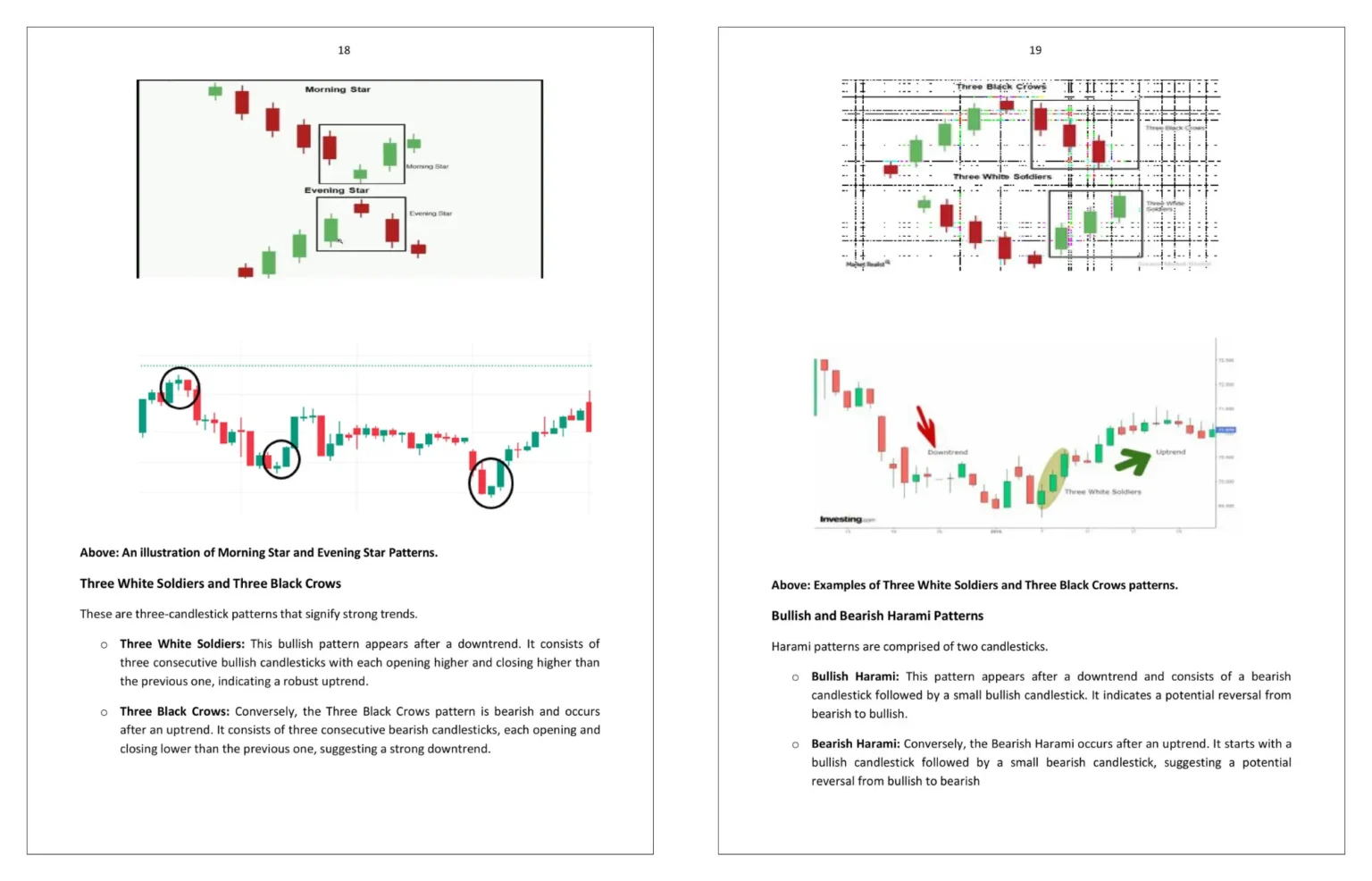

Hammer Pattern

A bullish reversal pattern with a small body and long lower wick, showing rejection of lower prices.

Shooting Star

A bearish reversal pattern with a small body and long upper wick, showing rejection of higher prices.

Trusted by Professional Traders

Don’t just take our word for it. Here’s what industry professionals say about this guide.

James Donovan

Hedge Fund Manager

“This guide bridges the gap between retail and institutional trading knowledge. The pattern recognition techniques alone have improved my win rate by 30%.”

Sarah Mitchell

Portfolio Manager

“The fundamental analysis section provides a perfect complement to the technical patterns. This dual approach has transformed my investment process.”

Robert Kim

Proprietary Trader

“The risk management section alone is worth the price. Finally, a resource that teaches proper position sizing and trade management for retail traders.”

Get Your Copy Today

Choose the package that fits your trading journey. All options include lifetime updates.

Digital Edition

Instant access to the complete guide in PDF, ePub, and Mobi formats.

- PDF, ePub, Mobi formats

- All future updates included

- Bonus: Pattern Recognition Cheat Sheet

- Instant download access

Frequently Asked Questions

Is this book suitable for beginners?

Absolutely! The book starts with foundational concepts and gradually progresses to advanced strategies. Each chapter builds on previous knowledge, making complex topics accessible to traders at all levels.

What markets does this book cover?

The principles taught apply to all liquid markets including stocks, forex, commodities, and cryptocurrencies. Specific examples are provided for each asset class.

How is this different from other trading books?

Unlike most resources that focus solely on technical or fundamental analysis, this book teaches how to combine both approaches for higher-probability trades. It also includes institutional techniques rarely shared with retail traders.

Are there any ongoing costs?

No. Your one-time purchase includes all future updates to the core material at no additional cost. The Premium Bundle includes 12 months of community access, which can be renewed optionally.